Price of state

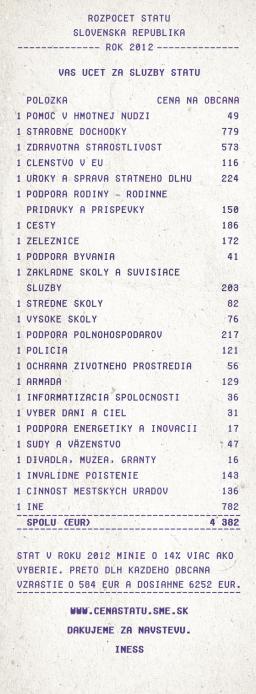

Estimate the cost of the state based on the following reasons. State price is expressed as a percentage of share in the redistribution of national GDP.

Employee creates monthly value € 868 (super-gross wage). Then, tax him 35.2% employer contributions (the gross wage). Then tax him again 19% income tax and levies 14%. It has been called the net wage. When he spends net wage in a month, the stores will pay 20% VAT.

How many euros do you pay through various taxes and levies from their work to pay the state? As a percentage and an amount of money (figures are streamlined according to the state in 2013 the Slovak Republic).

Employee creates monthly value € 868 (super-gross wage). Then, tax him 35.2% employer contributions (the gross wage). Then tax him again 19% income tax and levies 14%. It has been called the net wage. When he spends net wage in a month, the stores will pay 20% VAT.

How many euros do you pay through various taxes and levies from their work to pay the state? As a percentage and an amount of money (figures are streamlined according to the state in 2013 the Slovak Republic).

Final Answer:

Tips for related online calculators

Need help calculating sum, simplifying, or multiplying fractions? Try our fraction calculator.

Our percentage calculator will help you quickly and easily solve a variety of common percentage-related problems.

Our percentage calculator will help you quickly and easily solve a variety of common percentage-related problems.

You need to know the following knowledge to solve this word math problem:

arithmeticbasic operations and conceptsnumbersUnits of physical quantitiesGrade of the word problem

Related math problems and questions:

- The game of blind man's buff

The Slovak levy system makes gross wage deductions for your pay state employees. It has two components—part employee pays and part paid by the employer. Suppose that the super gross wage is paid 21% employer. After deducting these contributions, we receiv

The Slovak levy system makes gross wage deductions for your pay state employees. It has two components—part employee pays and part paid by the employer. Suppose that the super gross wage is paid 21% employer. After deducting these contributions, we receiv - Tax and death

Calculate 60% (aggregate taxes and levies) of 1000 euros of the gross wage.

Calculate 60% (aggregate taxes and levies) of 1000 euros of the gross wage. - VAT lottery

Father earns 809 euro a month, mother 480 euro per month. Calculate what amount they paid as value-added tax (VAT) to the government if the VAT rate is 20%. Assume that the family will spend their entire monthly income.

Father earns 809 euro a month, mother 480 euro per month. Calculate what amount they paid as value-added tax (VAT) to the government if the VAT rate is 20%. Assume that the family will spend their entire monthly income. - Solidarity

Imagine a word solidarity means that salt donation to the needy, who have neither the salt. If we take the word solidarity, it is a word based on salt + gift (only in the Slovakian language). Calculate how many kilos of salt a sympathetic citizen "gives"

Imagine a word solidarity means that salt donation to the needy, who have neither the salt. If we take the word solidarity, it is a word based on salt + gift (only in the Slovakian language). Calculate how many kilos of salt a sympathetic citizen "gives" - University bubble

You'll notice that the college is up slowly every other high school. Many people in Slovakia/Czech Republic study political science, mass media communication etc.. Calculate how many times more earns clever 24-year-old mason with a daily net income of 163

You'll notice that the college is up slowly every other high school. Many people in Slovakia/Czech Republic study political science, mass media communication etc.. Calculate how many times more earns clever 24-year-old mason with a daily net income of 163 - Fixed expenses 2013

Since 2013, the Slovak government has had plans to tax more small one-person businesses. Instead of fixed expenses, 40% will be fixed expenses 40% of gross income up to 420 Eur. Calculate the percentage of fixed expenses that will be paid in 2013 from gro

Since 2013, the Slovak government has had plans to tax more small one-person businesses. Instead of fixed expenses, 40% will be fixed expenses 40% of gross income up to 420 Eur. Calculate the percentage of fixed expenses that will be paid in 2013 from gro - Pension or fraud

Imagine your entire working life working honestly and paying taxes and Social Insurance (in Slovakia). You have a gross wage 970 Euros. You pay social insurance (you and your employer) monthly € 310 during 41 years, and your retirement is 446 Eur dur

Imagine your entire working life working honestly and paying taxes and Social Insurance (in Slovakia). You have a gross wage 970 Euros. You pay social insurance (you and your employer) monthly € 310 during 41 years, and your retirement is 446 Eur dur